Month in Review

- Stocks rose sharply in November, breaking a three-month losing streak. Gains were broad based across major markets.

- Bond markets also broke a five-month losing streak, posting strong results as short- and long-term interest rates fell significantly during November.

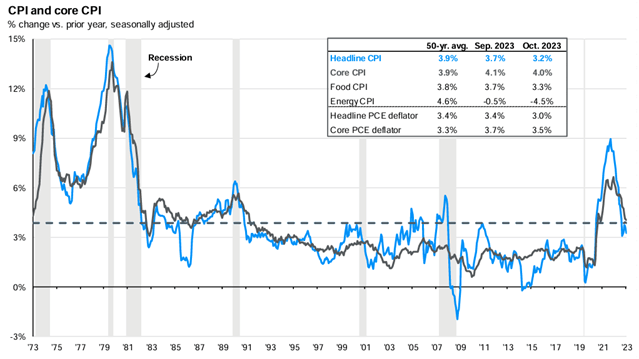

- Multiple data points illustrated that inflation is in continued decline, raising investor confidence that the Federal Reserve is done hiking and turning its focus to potential rate cuts in 2024.

A November to Remember!

November was a month to remember for investors: The S&P 500 posted its strongest November since 1980 (rising roughly 9%) and the Barclays Aggregate Bond Index had its best month since May 1985 (rising roughly 4.5%).

What were the catalysts for such a sharp reversal?

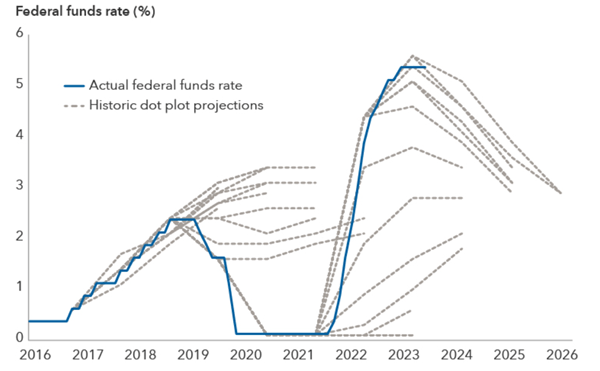

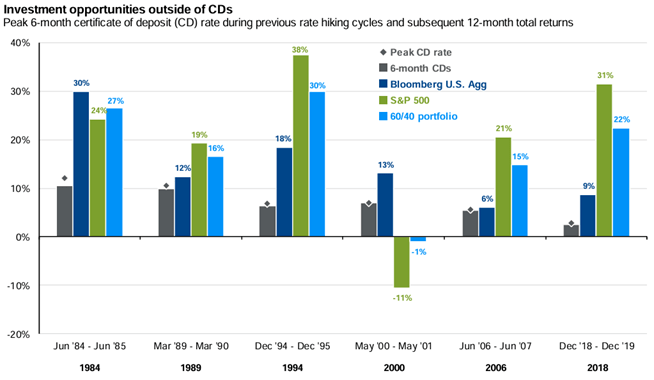

Investor sentiment had become overly negative – a three-month losing streak for stocks and a 5-month losing streak for bonds. This set-up was followed by unexpected positive developments on the fight against inflation. Multiple readings during November showed inflation rising by less than expectations. Federal Reserve officials also affirmed progress towards normalizing inflation, the decline can be seen in the exhibit below. The positive developments on inflation drove interest rates lower, sending stock and bond prices higher, as investors now shift their attention away from rate hikes to rate cuts.

Source: BLS, FactSet, J.P. Morgan Asset Management. CPI used is CPI-U and values shown are % change vs. one year ago. Core CPI is defined as CPI excluding food and energy prices. The Personal Consumption Expenditure (PCE) deflator employs an evolving chain-weighted basket of consumer expenditures instead of the fixed-weight basket used in CPI calculations. Guide to the Markets – U.S. Data are as of November 30, 2023.

What’s on Deck for December?

- Earnings season is wrapped up and government shutdown issues have been pushed out until January 19th and February 2nd of 2024.

- The Federal Reserve meeting on December 13th will be watched closely for comments on the timing and magnitude of the first rate cut and the on-going shrinking of the Fed’s balance sheet. At time of writing, futures markets are implying a 50% chance of a 25bps rate cut during the March 20th, 2024 meeting.

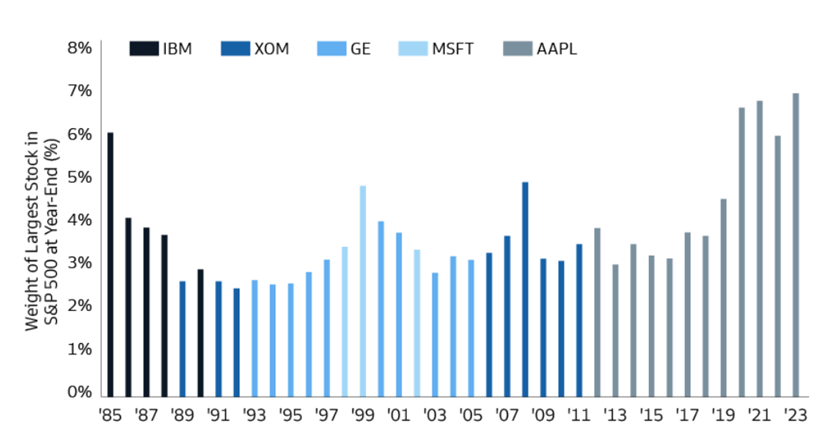

- As we enter 2024, the US Presidential election will once again be a focus. Despite a significant amount of noise, it is important to remember that the S&P 500 has only had negative returns in election years two of the last 20 election years (2000, 2008).

Download the November 2023 Market Recap below: