Month in Review

- April saw major bond and stock markets decline due to a shifting interest rate outlook, following higher-than-expected inflation data. The S&P 500 had its first 5% or greater drop since October 2023 in April.

- In the equity market – areas with greater sensitivity to high interest rates lagged, such as small cap stocks (-7.04%, Russell 2000 TR Index). Large cap stocks also declined, with value stocks down -4.27% (Russell 1000 Value TR Index) and growth stocks down -4.24% (Russell 1000 Growth TR Index). Emerging market equities bucked the trend and finished in positive territory (+0.45% MSCI Emerging Market NR Index).

- As of April 30th, investors were no longer pricing a cut to the Fed Fund rate for 2024, leading major bond markets to 2024 lows (-2.53% in April, Bloomberg Barclays Aggregate Bond TR Index).

Looking Beyond Narrow Equity Market Leadership

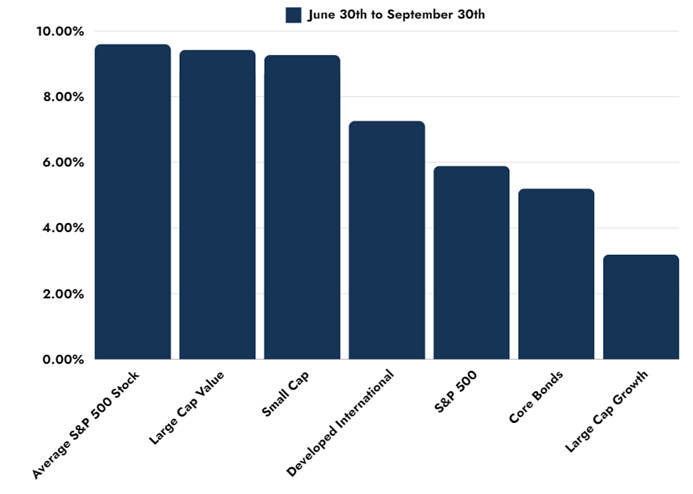

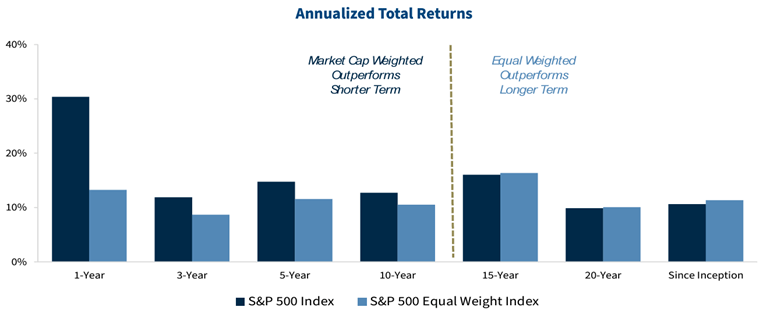

Large growth companies continue to drive a large portion of the US equity market’s results during the past three and five years – April was no different. The S&P 500 (weighted by the size of the companies in the index) has outperformed the equal-weighted S&P 500 (representing the results of the average company) by an increasingly wide margin over the past 18 to 24 months.

This has been driven by fast-growing technology companies: technology stocks represent roughly 30% of the market-cap weighted S&P 500, compared to 14% weight in the equal-weighted S&P 500. However, it is important to adopt a longer perspective during these unusual periods. Over the past 15- and 20-year periods, as well as since 2003 – the equal weighted S&P 500 index is ahead or in-line with the market cap weighted S&P 500. On a calendar year basis, the equal-weighted S&P 500 has finished ahead 12 out of 21 years through 2023.

Although the market has been very top heavy, with the fast-growing technology companies driving the market, markets are cyclical, and longer-time horizons highlight the balance over time.

What’s on Deck for May?

- Inflation data will be top-of-mind given the recent hot streak in data. Federal Reserve commentary around the data will also be closely watched by investors.

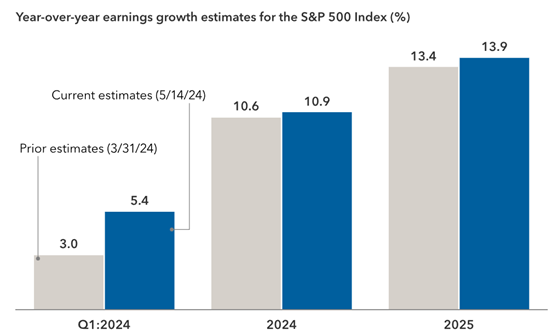

- First quarter 2024 earnings will wrap up in May. Through the end of April, earnings have finished ahead of expectations for S&P 500 companies that have reported.