The first quarter of 2025 has been a period of dynamic shifts in global financial markets, marked by evolving economic policies, heightened uncertainty, and increased volatility equity markets. In this edition of Market Pulse, we analyze key investment trends, including the broad rotation from growth to value stocks, the resurgence of international equities, and the stabilizing role of fixed income markets.

Despite market volatility, history reminds us that corrections are a natural and expected part of long-term investing. The recent pullback in the S&P 500, while significant, aligns with historical trends, reinforcing the importance of diversification and disciplined investment strategies. International markets, buoyed by fiscal stimulus measures, have provided investors with new opportunities, while fixed income markets have continued their recovery.

Looking ahead to the second quarter, trade and fiscal policy developments will remain critical factors shaping investor sentiment. By maintaining a strategic and diversified approach focused on their objectives, investors can navigate uncertainty and capitalize on emerging opportunities. On behalf of Confluence Financial Partners, we thank you for your continued trust and confidence.

Bill Winkeler, CFA, CFP®

Chief Investment Officer

Diversification Renaissance

• Uncertainty around the implementation of new policies and softening economic data weighed on markets

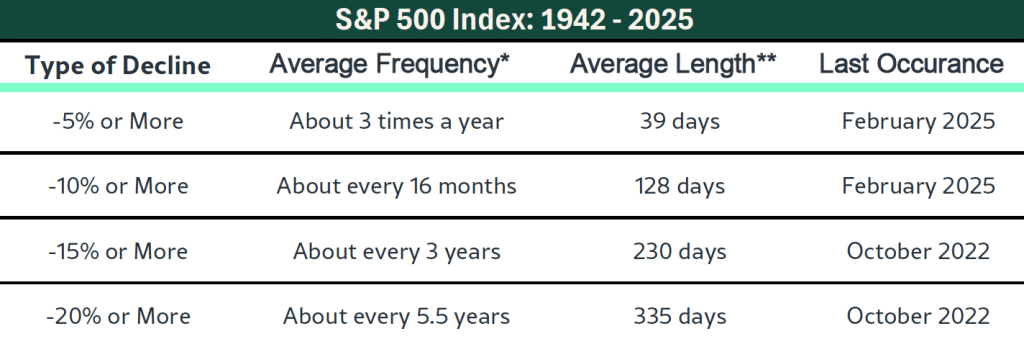

• S&P 500 had its worst quarter since 2022 and its first correction (> 10% decline) since October 2023, an event that historically happens roughly 1.5 years

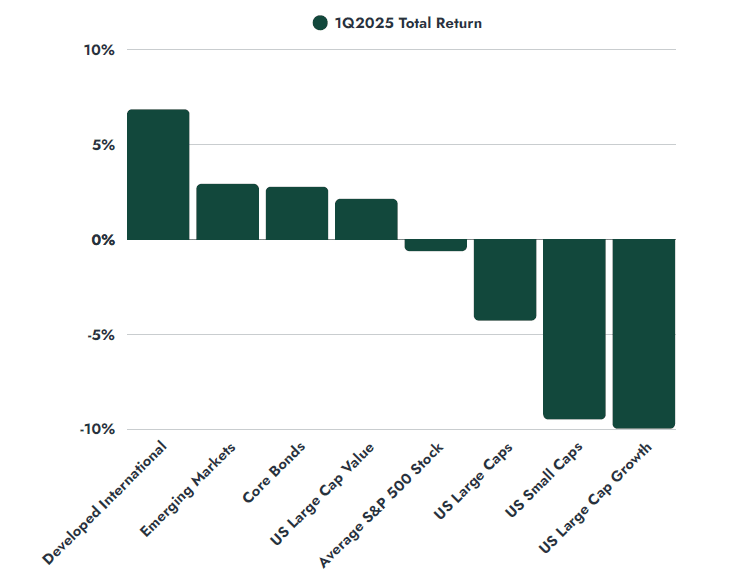

• This sparked a rotation away from Magnificent 7 and Technology stocks to Value and International stocks, with international stocks posting their best relative quarter in over 25 years

What Happened in the First Quarter?

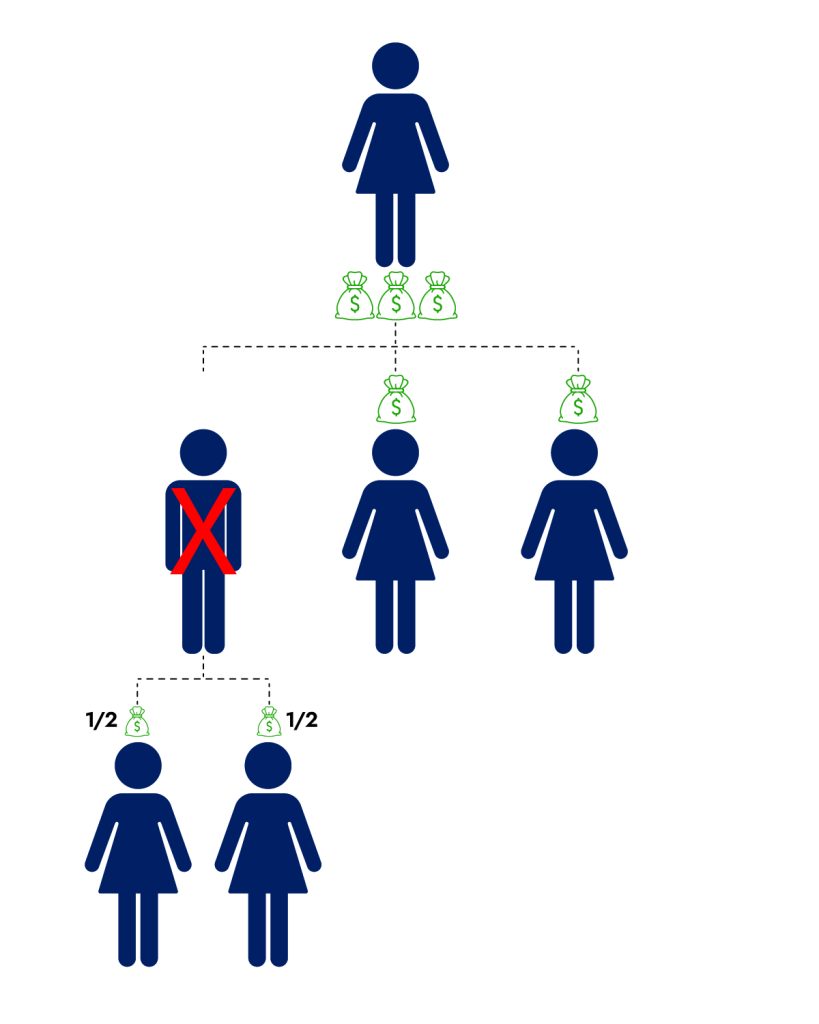

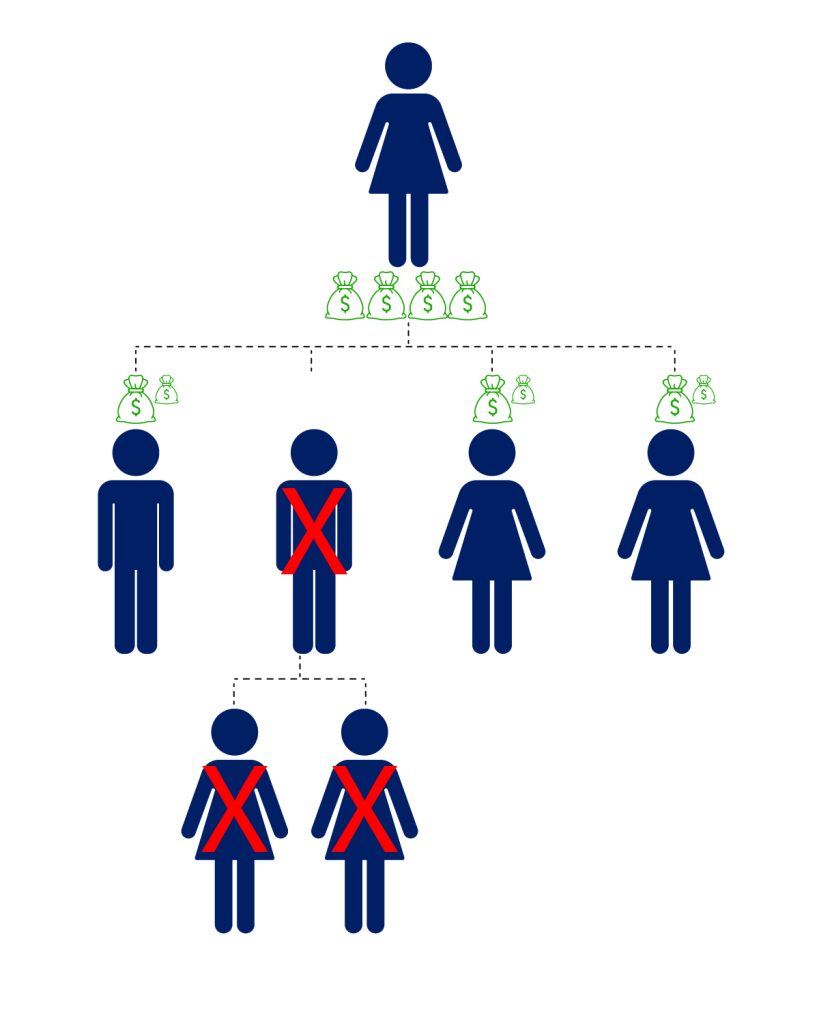

Investors spent the first three months of 2025 digesting the implementation of new policies, along with a shifting outlook for the economy. While “uncertainty” is often over-used, measures of uncertainty around trade and outlook for the economy spiked to very high levels, as investors sought more clarity around tariffs and related trade policies. The increase in uncertainty, combined with some softening of economic data (for example a mild increase in unemployment), helped to drive the first correction (decline greater than -10%) in the S&P 500 since October 2023. Previous market leaders – the “Magnificent 7” growth companies in the S&P 500 Index, were hit harder than the rest of the market, falling roughly -15% during the quarter. Importantly for investors, other equity markets and fixed income markets provided diversification benefits in the first quarter, and S&P 500 earnings expectations for 2025 have remained largely stable.

Diversification Means “You’re Always Having to Say You’re Sorry”

The old adage for diversified investors was invoked frequently in 2023 and 2024, in an equity market led by a handful of US large growth companies. Early in 2025, diversified investors have had the chance to say “thank you”, as investors have rotated away from US large cap growth companies, into large cap value stocks, international stocks and bonds. Even within the S&P 500 Index, the Magnificent 7 Stocks fell roughly -15%, while the remaining 493 stocks in the S&P 500 Index were flat for the quarter.

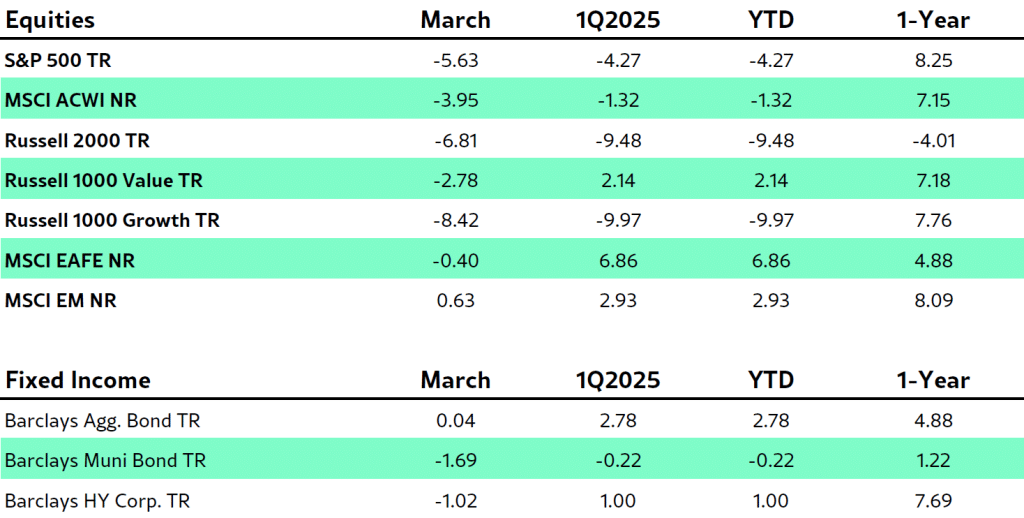

Sources: Morningstar, Average S&P 500 Stock = S&P 500 Equal Weighted TR Index, US Large Caps = S&P 500 TR Index, US Large Cap Value = Russell 1000 Value TR Index, US Large Cap Growth = Russell 1000 Growth TR Index, US Small Cap = Russell 2000 TR Index, Developed International = MSCI EAFE NR Index, Emerging Markets = MSCI Emerging Markets NR Index, Core Bonds = Bloomberg US Agg Bond TR Index

The start to 2025 for international stocks has been one of the strongest in the past 25 years, as US investors benefitted from both rising foreign stock prices and the depreciation of the US dollar. International equities have been inexpensive but lacking strong fundamental catalysts, which began to change during the quarter. In Europe, Germany introduced a very large fiscal spending package to stimulate their economy, the largest in their history (exceeds the Marshall Plan and Reunification). The changing attitudes towards spending by European countries has been well received by investors.

Results for fixed income investors continued the positive trend in the first quarter of 2025 as well. After the worst calendar year in its history in 2022 (-13.01%, Bloomberg US Aggregate Bond TR index, data back to 1926), the bond index posted a gain of +2.78% in 1Q2025. This follows consecutive calendar year gains in 2023 (+5.53%) and 2024 (+1.25%). Interest rates have declined across the yield curve, with the 10-year Treasury yield finishing the quarter at 4.23%, down from intra-quarter highs of 4.79%.

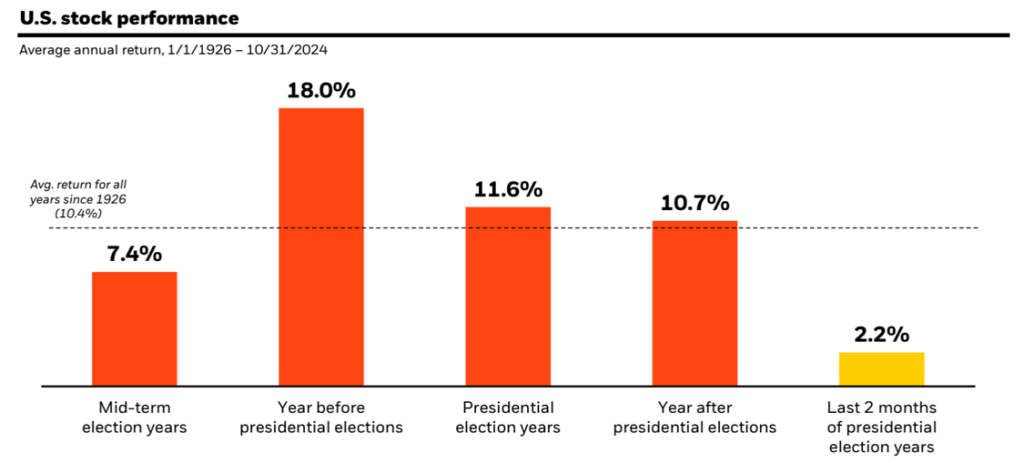

Very Average Correction

In the previous edition, we noted that 2023 and 2024 were very strong years for the US equity market “The strong year for the S&P 500: 57 new all-time highs and consecutive +25% calendar year gains, was thanks in very large part to the largest companies in the index.” Early in 2025, investors were reminded that volatility is a very normal and common feature of equity market investing. From February 19th, the S&P 500 fell over -10% in less than 30 days, making it the 11th fastest correction since 1928. Quickness aside, the frequency was very average – 60th correction since 1926, the first since October 2023, right on the historical average frequency. Investors may be wondering if this will turn into a bear market (a decline greater than -20%): while no one has a crystal ball, out of the 59 previous corrections since 1926, only 17 ended up turning into a bear market (roughly 29%). The S&P 500 recently experienced a bear market in October 2022.

Source: First Trust, Bloomberg. Data from 4/29/1942 – 2/28/2025. Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. Investors cannot invest directly in an index.*Correction cycles are determined by identifying market declines in excess of the minimum declines noted above. The cycle ends when there is a recovery of the magnitude of the minimum decline needed for that correction size (i.e., a recovery of greater than 5%, 10%, 15% or 20%). After that recovery is noted, the algorithm begins searching for the next decline to start the cycle again. **Measures from the date of the market high to the date of the market low. The S&P 500 Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance.

Corrections and bear markets, along with normal intra-year declines, are the toll investors pay for the long-term results of equities. Since 1980, the S&P 500 TR Index has had average annual declines of roughly 14% every year but still finished the calendar year in positive territory 75% of the time. This illustrates the importance of staying invested during volatility and ensuring that your investment portfolio is aligned with your objectives and financial plan.

What’s Ahead for the Second Quarter?

Changes to trade policy are having a tangible effect on investor and consumer sentiment, with the potential to negatively impact economic growth. Both investors and the Federal Reserve are looking for greater clarity on how additional tariffs could be implemented, which will play a key role in any changes to the Federal Funds Rate in 2025. Within fiscal policy, any changes to tax policy in the United States are trending towards happening later in 2025, but developments there will be watched closely by investors. As discussed, international equities have benefitted from a strong fiscal impulse from Europe, with the implementation likely to be in focus during 2Q2025.

Markets In Review