Heather:

Thank you for attending the Confluence Financial Partners Quarterly Webinar, 2021 Outlook “What’s It all about?” with Greg Weimer and Jim Wilding. We’ll be starting shortly.

Greg:

Thanks, Heather. This is Greg Weimer and I just wanted to welcome all of you to our webinar on behalf of my partner. So you can see, hopefully on the screen, Jim Wilding and all the associates of Confluence, we want to welcome you to the webinar and tell you, we are very, very grateful for the relationship and it’s been a challenging year, but we got through it together. And our thoughts and prayers obviously go out to all of the people that have been affected by the horrible pandemic that we’ve been through. So, we continue to pray. We continue to stick together and let’s all just believe there are greater days ahead. I think at a time like this, in January, everybody tends to say, “happy new year.” And I was thinking about that and just thinking, well, happy new year, that sounds like somewhat hopeful.

How about we all together agree as a team and we start saying, “let’s make it a great year.” That just sounds a little more active. Like, we have some control, which we do. So, let’s say, “let’s make it a great year” instead of the past. So, I’m hoping it’s a great year. So, to all of you, let’s make it a great year. We look forward to continuing to work with you. And in that regard, just to say, congratulations. It was a challenging year. In fact, I just looked, if you didn’t pay attention in the last year, you would have thought it was somewhat boring. The Dow Jones Industrial Average was up 7% from 12 months ago today, which is amazing. Now other indexes could have, or were up a lot more, but the Dow Jones Industrial Average is the one that a lot of people think about and it was only up 7%.

So, it’s like not much happened, boring year, 7%. Not really. So, but I will tell you, we navigated it well as a team. And, and I just want to thank all of you, and we want to thank all of you for your, you know, your informed patience as we got through this year, because it was bumpy. We’re not dancing. You know, if you’re running a hundred mile race, you don’t, you don’t celebrate too much when you, when you do well for one lap. But I think our team, with you at the driver or steering wheel, the driver’s seat, I think we did well. I will tell you that your spotter, your crew chief and the pit crew, all worked really well together, but without all of you looking through the windshield and focusing on your goals and looking forward, we wouldn’t have navigated together as well.

So, we want to thank you for just sticking with us and making sure we got to the end of the lap. We have a lot more to go, but thank you. And congratulations. Here’s what we thought we’d talk about today. The agenda for today is really, it’s reflect and plan. So, I’m going to turn it over to my partner, Jim Wilding. And he’s going to talk about the 2021 outlook, and then I’m going to come back on and we’re going to talk about how we can, our passion, your passion is how we can plan to help you maximize your life and legacy. But first I’d like to turn it over my partner, Jim Wilding.

Jim:

Thanks very much, Greg let’s make 2021 a great year together. And thank you to everybody for joining us today. As Greg mentioned, I’m going to give an outlook for 2021, but I’m going to start by giving a quick market recap in 2020. We’re going to talk a little bit about the worldwide economy and we’re also gonna talk about stocks and bonds and the some of the valuation issues going on right now in some of the areas where we think there could be a good potential within the next year.

2020 was sure an unforgettable year. We can go to the next slide. There are lots of things about the year we’d like to forget, but I doubt we ever will. The market actually got off to a good start in 2020. As a lot of you might remember, mid-February, it was up almost 5% for the year on February 19th.

That was the peak before the decline. The S&P 500 was at 3393, but that was the peak for a while. And what followed was, was real challenging. The spread of the coronavirus with a simultaneous huge drop in the price of oil led to a major decline in economic activity and stock prices. The ensuing loss of jobs produced 22 million unemployment claims in a month. And just to give you a historical perspective about that, if you went back to the great recession that we had in 2008, in 2009, cumulatively, over that whole time, we lost about 9 million jobs. So, 22 million in a month was unbelievable. The chart on the left hand side of the screen shows that by Friday, March 20th, the S&P 500 was down 35% from its high just four weeks ago. From February 19th to March 20th, that decline was actually the fastest drop of 30% or more ever.

And as almost all declines do, it felt awful and nobody knew how much worse it might get. The next week on the right-hand side of the screen, we see the recovery that began three days later. On Monday, March 23rd, the day the Federal Reserve came out and announced that it was committed to using its full range of tools to support households, businesses, and the U.S. economy overall. Amazingly, right after the S&P 500 completes its quickest decline into a bear market, we actually have the best 50 days ever for the market. And by late August, we’re actually back to a new all-time high for the S&P 500. The early fall is challenging. You might remember the focus turns to elections and September and October were both down months. The market pundits on CNBC, CNN and Fox News tell us that divided government is the best election outcome that we could hope for.

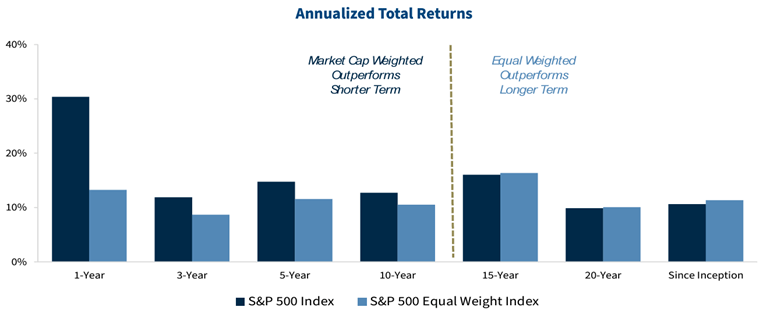

Sounds good to me, as you know, that’s not what happens. And the S&P 500 now is up about 13% since the election day, a little over two months ago. We think 2020 might just be the best year ever for illustrating the impossibility of timing the market. Last year showed that even if you could somehow accurately predict a global pandemic and a U.S. Presidential election, you probably could not reliably anticipate the market reaction for the year. The S&P advanced by over 16%, as Greg mentioned, the Dow was only up seven, and there was a big disparity between the returns generated by traditional dividend paying stocks and growth stocks. We’ll talk a little bit more about that later.

We could be on the cusp of a synchronized worldwide economic recovery. 2021 has the potential to be a year where most of the world’s major economies are growing, which could be very good news for global stocks. The International Monetary Fund estimates that global economic growth will exceed 5% in 2021. The current recovery in China has been surprisingly swift, as you probably realize China is the world’s second largest economy. They are expected to have growth, not only in 2020, but also in 2021. The U.S. contracted in 2020 by about 4% slightly over. It’s anticipated that our economy is going to grow by a little bit, over 3% in 2021. And as the chart shows on the screen, emerging markets are actually expected to do even better, up about 6% in 2021. We think all of these growth forecasts are very dependent on the vaccines implemented around the world.

In addition to a strong worldwide economy, a weaker dollar may also strengthen the non U.S. markets. The dollar has been in a bull market for about 10 years. That cycle may start to change with our super low interest rates that we now have in the United States and drastically higher government spending. The dollar may become a little bit less attractive. The valuations of non U.S. markets are also significantly lower than U.S. markets. Said another way, expectations for companies outside of the U.S. are generally not as high, which may turn out to be a positive for the non U.S. portion of our portfolios.

As I mentioned in the 2020 recap and that, and you can see on the left-hand side of the screen, the Fed cut rates drastically last March and pledged to keep rates low for the perceivable future. An ultra-low interest rate environment encourages investors to move assets out of the safe havens and into riskier investments, especially stocks. And I mentioned earlier that growth stocks had done very well lately. One of the reasons is actually the very low interest rate. A company shares are valued, not just by the current earnings, but also what the projected future earnings are going to be. And that valuation is made by discounting back to today. All of those future earnings, when you have a discount rate that is drastically lower than the old discount rate, you’re going to come up with a much higher number for what the value of that company would be.

It’s really the exact same math that allows you to buy a much more expensive home with the same monthly payment when the mortgage rate is 3% instead of 8%. So very low interest rates do generally make stocks more expensive. The long-term decline of interest rates is like having some wind at our back, helping us if we’re investing in stocks. So, one of the things we gotta be aware of now is the long-term decline of rates. That’s probably over. You can see on the right-hand side of the screen, that the Fed’s announcement on March 23rd kicked off the fastest recovery from a bear market. Once the market was confident that the Fed was going to help with all of its tools, the recovery was on. The old saying is don’t fight the Fed. With interest rates so low now, one of the questions that we get quite frequently is it, does it still make sense for investors to have bonds in their portfolio?

And for a lot of investors, the answer is still yes. And here’s why. What happened in the stock market last February, March potentially could happen at any time. And so, there’s two main reasons you’d want to have some of your portfolio in bonds. Number one, if you have a cash need in the short term, whether that’s your retirement living expenses, paying for your child’s college tuition next year, an upcoming wedding, you don’t want to have to sell when the prices are low. So, it makes sense that some of your money in bonds or money market. It’s what we call having the bucket strategy.

The other reason would be if you prefer your portfolio to not move down during the temporary stock market setbacks, as much as the stock market does, it probably makes sense to have bonds in your portfolio, because that would lessen the decline. We can help you build a plan and determine what the right percentage of bonds in your portfolio should be for your risk tolerance. And that still lets you accomplish your long-term goals. But for long-term investors, bonds do not currently offer what they historically have, which is a somewhat reduced return with significantly less risk. Today it is almost no return. And you do have risks with longer-term bonds. The average yield on the ten-year Treasury during the past 60 years is almost exactly 6%. Today, the ten-year Treasury yields about 1%. So you have to have six times as much money in those bonds to get the same amount of interest that you would’ve gotten on average over the past 60 years. It is our opinion that bonds today are a lot more expensive than stocks.

Amazon, Alphabet (also known as Google), Facebook and Netflix — those are the names that most people think about when they think about digital leaders. But there’s also a lot of online payment processors, cloud computing providers. Microsoft is one of them. And chip makers, such as Taiwan Semiconductors that are also digital leaders. Not to mention companies in such varied industry as personal fitness, automobile sales and foot and athletic wear. Companies with strong digital business models have an advantage. And that advantage widened substantially during the coronavirus outbreak. A senior analyst at an investment firm that we use in our portfolios said, “the growth rates at companies with a digital advantage have been phenomenal during the downturn.” And in my view, we’re not going back when the pandemic is over. We may see slower growth rates, but I don’t think a lot of people will be canceling their Netflix subscription or returning their Peloton bike. As always, beauty is in the eye of the beholder.

And there are some cases where the market might be placing an unsustainably high premium on a company’s digital model. The market might be, in some cases, a little over enthusiastic about that. And I’ll give you one example, and I’m not saying for sure, this is, but this is a valuation difference. So, CarMax is an established car retailer been around for a while. They sell about a little over $20 billion of cars a year and their latest year, they had pre-tax income of $1.2 billion. Their stock was up about 15% in the last 12 months and the market values their total enterprise at about $17 billion. A much newer car retailer that has a more of a digital platform is Carvana.

They have annualized, right now, about $5 billion in sales in a year. They have yet to make a profit. In their most recent full year, they lost $365 million. Their stock in the last 12 months was up 237%. The stock market places a value on them of about three times as much as CarMax. Their value is just under $50 billion. So not all experiences can be digitized and digitized for phenomenal success. And there’s pent-up demand for a lot of those businesses. Have you heard of the flight to nowhere? Probably not, but on October 10th of 2020, 150 restless passengers boarded a seven hour Qantas flight from Sydney, Australia to Sydney, Australia, and the flights sold out in 10 minutes. Wow. I’m not the biggest fan of air travel, especially if I’m going nowhere, but maybe I’m in the minority on that.

Air travel is back to pre-coronavirus levels in China. As you can see from this chart, I doubt the U.S. can be far behind. After September 11th, 2001, there was a lot of talk that air travel was permanently going to be low. That turned out not to be true. I think there’s a lot of behaviors due to the coronavirus that we have a feeling that maybe it’s not going to come back. I think in a lot of ways, it is going to come back. Certainly, the pandemic has expedited changes in our society, for sure. Online shopping and working from home. They might never go back completely to what they were pre-COVID, but most people are very eager to return to many parts of our old ways of doing things, attending concerts, going to casinos, attending live sporting events, eating out at restaurants and traveling. I had with, with some other associates in Confluence, we had a few meetings this week with clients reviewing their plan. And each of the clients mentioned that in the next few years, they intend to travel more than they normally would because they didn’t get to travel in the last year.

There are many airline cruise, hotel, entertainment and restaurant companies whose businesses could be back to booming soon. Not everything can be done on a computer. In summary, I went over the stock market of 2020, a crazy year, but maybe the best one ever for learning or relearning some of the most important lessons in investing. It’s not tim-ing the market, it’s time in the market. And don’t let your political views shape your investment philosophy. We talked about a synchronized worldwide economic recovery that we think could be coming in the near term. And we do think that’s pretty dependent upon the vaccine availability and how the rollout goes. And then, finally we believe equities remain significantly more attractive than bonds, but for a lot of investors, bonds absolutely play a very important role in your portfolio and your long-term plan. With that, I’m going to turn it back over to my partner, Greg. Thank you.

Greg:

Hey, thanks, Jim. We appreciate the update. And the review of 2020 and thinking about what’s going to happen in 2021 and beyond. And by the way, I agree with you. It was if you, if someone had told you exactly what happened last year, even if you knew exactly what was going to happen, your response as an investor may not have been to stay invested the whole time. But it also reminds me of the saying, you never get hit by the bus that you’re watching. And it’s so true, but even though you don’t get hit by the bus that you’re watching, it doesn’t mean that you don’t need to plan for it. On a positive side, you know, I think that was an interesting year. When you, we watched the private sector companies, we watched science and we watched government come together to focus on one enemy.

And that is the pandemic. And 12 months later, we have a vaccine. That just shows you the human spirit. When it comes together, we really can solve great things, right? If some people are thinking, yeah, but what’s going on in TV sometimes what, regardless of what news channel you watch, can be disappointing. I totally agree. We totally agree. But at the end of the day, as a society, we have not been very good at solving problems. We have been great at solving a crisis, and this is a crisis and we’re closer to the end than the beginning. We’re not in the prediction business. Obviously, we are, in the end, in the anticipation business. I think there’s a subtle difference there and we’re in the planning business. So, one of the things that we, that I’ve noticed, I’ve had the privilege and I’ve been blessed to be around some just brilliant people over the years.

And what I notice about these brilliant people, they don’t pride themselves on having the right answers all the time, but they’re brilliant. And making sure that they’re asking themselves the right questions. So, my goal and my segment is helping you really think about maximizing your life and legacy, is just really challenging you. Challenging you to ask the right questions of yourself. I’m going to give you five. There’s a lot more questions we should be asking together, but let’s go through the five questions that if you ask yourself this year, let’s make it a great year. If we ask yourself these questions this year, at the end of the year, you’ll be better off than you are at the beginning of the year. So, let’s go to the first question.

It’s a simple one that we don’t ask enough, and we don’t ask this enough. And it’s, what’s it all about? And there are purposefully a piece of driftwood on the beach. And you know, I mean, at one point that driftwood was a tree and vibrant now it’s driftwood. And I, and I’ll tell you what caused me to think about this? And, and I’m reminded all the time to ask myself, my family, my loved ones, “what’s it all about?” I was in Turks and Caicos, and sometimes people can make a huge impact on you and not even know. And this gentleman in Turks and Caicos did. We were sitting, looking outside. I wish we had this weather now, but we we’re sitting in a hut. One of those high bars up by the beach and this older gentleman, and he is in his eighties, but I’m telling you, this guy had spunk.

He led a full life and you could just tell he had that…He had that “it” about him. And he said to me he said, son, never forget to ask, ‘What’s it all about?’ And I said, Oh do tell, tell me about that. What do you mean? He said, Well, 20, 30 years ago, I was out in the ocean, he went to Turks and Caicos every year. He said I was out in the ocean and I saw a piece of driftwood and I grabbed the piece of driftwood and I wrote on it, “What’s it all about?” And he said, I put that on top of my bed and I have it in my bedroom. So, every day I asked myself the question, what’s it all about? In 2020, if there was ever a year that we should be asking ourselves, coming off of that, what’s it all about? It certainly should have happened last year. So, we really, you know, so the question becomes, what’s your portfolio all about?

Is it just about money? Or if you look at the next slide, is it about creating moments with you, your family and your loved ones? Most people would agree, at the end of the day, that’s what it’s all about. And oh, by the way, if you look at the couple, I never thought of it, but they sort of matching hats on, which is odd, but right above the TS, you see the couple, let’s assume they’re 75. Guess what? They have 12, their life expectancy, they have 12 more expected Christmases or summer vacations with their family. That’s what it’s all about. Maybe you want to create a legacy, whatever you want to do. We have to remember, life is short. Like, let us help you with the dash. We all have a dash, right? Two dates and the dash. The dash is your life. But at the end of the day, what’s it all about is moments.

And we want to help you plan for those moments. Maybe you say, I’d like to buy a house in Florida someday. Well, that day, may be today! We can help you figure that out mathematically and say, yep, let’s go get that house in Florida, so you’re really enjoying special moments with your loved ones. So just really thinking about that and really thinking about what’s it all about.

Let’s go to the next set of questions. Are you protected? I don’t think you’re going to enjoy those moments if you’re worried about risk. So, we need to help you with that. You know, we spent a lot of time on helping you maximize your wealth, but you know, if an unforeseen event comes and it throws you off your plan, we haven’t really helped you. So, we’ve noticed this year, we’ve been asking the question, tell us about your umbrella policy.

And it’s interesting. And, by the way, it’s with your homeowner’s. So, we just want to make sure this year that a few had an unforeseen event where you were sued because of an accident or whatever, that you have the right umbrella policy. It’s fascinating how many times we see clients with an umbrella policy that, that you may not even know what your coverage is. So, we want to help you with that income protection. You know, what happens if something happens to you? What if you die prematurely? What if you become disabled, let us help you with that. And then the one that I think, the truth be told, the other moat that you can build around your castle, that a lot of people worry about, because the senior care, because not only are you worried about senior care on what it means to you, let’s be candid.

It also is a concern of what it means to your family and the burden that they may have. So, we’re not suggesting by the way, long-term care is for everyone. You may have enough money in your portfolio that you’re protected already. And that’s great. We’re not suggesting that everybody go out and buy long-term care, but we are suggesting, it probably makes sense to do that evaluation in your plan. And when you look at the next slide that shows some data points on long-term care, and I don’t know about you, I sort of find them startling. And unfortunately, surprising. And I’ll just acclimate you to the slide. So, the top bar chart, the one in green shows that 69% of us will have some type of a long-term care event. Now, in all fairness, a big percentage of those will be unpaid home care by family and friends, but still, I mean, when you look at the amount of people in nursing home, it’s still 35% will have an event that has, that causes them to go a nursing home.

The one that’s also startling for me and everybody receives this information differently. It’s the purple one. And I guess that gray line at the bottom, the bars. And it says, ‘greater than five years.’ It’s amazing to me that if you’re a man, you’re going to have a one in ten chance of needing some type of care for more than five years. And if you’re a female, it’s one out of 20. So, we want to help you with that. I know that everybody says, I’m going to look at that someday. Let’s make some day today. So, then you can be at the beach with your loved ones and you don’t have to worry about all these potential events, what ifs. One of the peace of mind we can give you is, we can help you think about the what-ifs and give you some certainty around that.

When you look at the next slide, this just takes me back to March. I don’t know if you remember. We were, I think almost begging people to say, let’s focus on the horizon, not the waves, the waves will make you sick. And let’s stay focused on the horizon. By the way, it is interesting how technology changed. We were on conference calls when we thought we — now, all of a sudden, everybody knows how to use Zoom and we’re on a teleconference. Wow. I mean, the pandemic sure did all teach us how to use technology and accelerated our growth. But this is the picture. And we wanted to share this again, because when you look, there’s two ways you can live your life. There’s two ways you can think about investing. When you look at the line going across, to me, that looks like an EKG.

The good news is the patient still alive, but it looks like an EKG. The mountain chart, the blue getting bigger over time. That is, that is the same investment from 2010 to 2019. So, let me make that a little clear. The EKG is the S&P 500 results on a monthly basis. Said differently, if you’re going to make decisions based on monthly investment results, good luck. If people are telling you they can make investment decisions based on monthly investment results, run away. More importantly, if you focus on the horizon, it’s a very, very, very different path, very, very different feelings. So, ask yourself in what timeframe am I thinking. Now, by the way, in productivity. So, if you want to get a lot done today, you think in terms of 30-minute increments or 15-minute increments, that doesn’t work in investment. You need to think in terms of 10-year increments.

Because if we make a mistake in thinking short-term increments, and it affects our behavior, it’s not like it’s hard to catch up. Think about it. If you’re in a boat and there’s waves and you jump out of the boat — by the way, not a good idea. If you’re ever in the middle of the ocean and there’s waves all around the boat, don’t, don’t, don’t, don’t jump because what’s going to happen is, when you want to go get back on that boat, the boat is going to keep moving, and you’re never going to catch up to that boat. Look at the next slide. That’s a story. Here’s the proof. These are, this is 2010 to 2019. If you invested a thousand dollars and kept it invested in the S&P 500, you almost would have tripled your money.

If you lost 10 days, just missed the 10 best days. You’ll see, you almost doubled it. So you would, the boat’s gone. By making that decision, you’re never going to catch it. You’re trying to get back on. We’re gonna try to help you, but you’re never going to catch the boat or the people that didn’t jump. So that’s the math behind it. And interestingly enough, and we’ll have people say, you know, I want to wait until I feel better with the market. Well, guess what? When you feel better, let me make my point. Some of these, these days, when you look back at the S&P 500, and you look back, you go back to the 1930s. You could look 2000, whatever you look at the 10 best days, like going back, the 10 biggest increases percentage, not points. People look at points in the media. It doesn’t make any sense. You gotta look at percentages. The best day ever was in 1933. The market in one day went up 16%. I’ll remind you, in March, why were we saying stay in, stay in, don’t jump out of the boat? Because in March there were two days, in March alone, that the market went up, indicated by the S&P 500, over 9%. Two days. And oh, by the way, other great days were days in ’08, right after 1987, because what happens is — it’s a rubber band and the market, as it goes down, it does snap back. So, by the time you feel better, you may have missed the opportunity.

I don’t even know. I don’t like the next slide, but we got to talk about it. So, let’s go to the next one. Will taxes go up? I think people are asking that. You’re going to see a lot in the media.

This is a tough one, because if you figured out how to predict what these folks are doing in DC, you’re a heck of a lot smarter than us. But we do need to prepare for it. Because there’s a lot of talk about income tax going up, capital gains going up, and the estate taxes going up. So, we need to think about that. I mean, I will give you an opinion. I don’t know if Jim shares it — my opinion is that this will be more of a 2022 issue than a 2021. And the reason for that, that is you don’t put all the medicine into the patient in the new stimulus and then ask them for their blood. And cash in the stimulus is what’s really causing the economy to hum along and start to look like it could recover.

So, we’re putting money into the economy. It’s hard for me to understand, although I wouldn’t be shocked, if at the same time, they’re taking money out. So, I think what we’re going to hear, at least at the beginning of 2021 is we’re gonna hear about stimulus. And we’re going to hear about $2,000 checks and putting money in. Having said that, either at the end of this year or 2022, you’re going to have your income taxes are going up, going up capital gains. And clearly, you know President Biden’s proposals are out there, but, you know, it’s such a thin, thin majority in the House and the Senate, there’s likely to have to be some, some, some moderation in that. But the big, we just got to pay attention to these this year, we are here to help you, you know, do some tax planning with your accountant.

So, if you want to do some of that, please reach out to us. We have a lot of great tools. You know, a lot of people don’t even know their actual income tax bracket. You know, what are your capital gains, you know, and capital gains, is there going to be a step-up in basis that goes away? I don’t know. One of the things on capital gains, it’s interesting how many people don’t use appreciated shares to donate to charity. So, you know, we should do that. Before you donate $20,000 to charity, call us. We have appreciated shares that you should probably donate instead. I’ll tell you the big one — estate taxes. I mean, estate taxes are huge. I don’t think most people really focus on it enough. And I think we’ve been lulled to sleep on this one a little bit, because the currently, anything over roughly 22, $23 million, anything over, anything under that amount, you don’t have to pay estate, federal estate taxes on.

But you should know, in 2025, that’s coming down. And you should also know there’s some proposals right now to bring it down to 7 million. And that’s husband and wife, obviously one spouse, it would be, it would one, a single person, it would be half that. But it can be a lot of money. It could be millions. So, you know, in Pennsylvania, between federal and state, you know, to be 45%. And you should know, 17 states actually have an estate tax. So, there’s things we can do. We need to ask these questions together because there could be a lot of planning opportunities that we can work on this year.

The fifth thing and final — enough about taxes. Fifth one: Is it time to talk? We’ve talked about this before, but is it time to talk? And I’ll remind you, it’s tragic: 70% of wealth that’s inherited is squandered in the second generation, by the way, 90% in the third. Number one reason: lack of communication.

And everybody has different types of meetings. It doesn’t mean that I’m going to tell my heirs exactly how much money you have. Some people are comfortable with that. Some people aren’t and our family, we’ve had, I think we’re on four family meetings and they get better. We do them every year. So, it could be: what moments do we want to do? What moments do we want to have in our family? Let’s make sure our dashes together are special, right? Let us help you facilitate those. I was in Chicago, meeting with just a great friend, he’s probably on the call. So just a great friend. And it was a Saturday morning. We were meeting with his whole family. And we were talking about like, you know, what you care about. And we, many of you we’ve done this with also, we’ve had the pictures out and say, okay, which pictures?

And Jim’s smiling. I think he knows the story. So which pictures, you know, talk to you? So, it could be time on the beach. It could be you know, whatever, it could be a charity. It could be the symphony, what talks to you, the arts, whatever talks to you. Every family member. Cause it’s hard to put into words how you feel, but when you have pictures, that allows you an opportunity to express yourself through the pictures. So, the father, my good friend, he picked he picked the skydiver and one of his children said, dad, you want to sky dive? And he cursed a little bit. I’ll let that out. And he said, no, no, I don’t want to sky dive. I want us to have moments. I want us to have moments. As a family, I want us to have moments.

So, whatever those moments are for you, it’s not about skydiving. It’s about making sure, if you’re 75, you make the next 12 years of your life expectancy truly special. And or it could be like, what charity did we, do we care about? Let’s go, let’s go bend the curve on mental health for goodness sake. There’s so much to be done. And then, end of the day, when we become, you know, when we meet at the end, at least we have a legacy. And at least we have moments, because at the end of the day, that’s all that really matters. So, there are the five questions. You probably have more. We have some more, let’s get together by asking those questions. We’re not going to just look at each other and say, happy new year. We’re going to say, let’s make it a good year.

And we’re going to do the planning. That’s going to allow us to do it. So next slide and recap. 2021 market outlook and beyond. Thanks, Jim. That was a lot of that was a lot of great information. That’ll allow us to make great decisions. And then, you know, I just wanted to give you some things to think about. I think the greatest thing one adult can do for another is cause them to think. And hopefully it just inspired you to write a couple of notes. I am going to look at my umbrella policy this year. I am going to talk to my family. I am going to think about my estate, my legacy and my life, whatever those things are.

You know, just in closing, we are here to help you maximize your life and legacy. And I got to tell you, it is not our goal. It is our passion. So, we have a passion to help you maximize your life and legacy. And we are well aware, in reflecting on last year and talking to a lot of people, we are stunned actually in the last couple of months, how many people we’ve talked to that, not everybody navigated as well as all of you. And it is our passion to help you.

If you’re a client on the line, tell us how we can help you more. If you’re someone that is thinking about coming to become a client, let’s talk, we want to help you maximize your life and legacy. And this is an offer from the bottom of our hearts. We know it’s a challenging time. If you have a loved one and you think we can help them, we stand ready to help them. We want you to introduce us to your friends and your family. If in fact, you think we can make a difference in their life and help them ensure the moment.

So, in closing, on behalf of Jim and on behalf of the rest of the team of Confluence Financial Partners, we are grateful for our relationship and we’re going to work as hard as we humanly can to continue to get results for you. Thanks.