When it comes to estate planning, your beneficiary designations are one of the most critical yet often overlooked components. These designations determine how your assets—such as retirement accounts, life insurance policies, and annuities—are distributed upon your passing. Beneficiary designations often supersede other estate documents, making it essential to ensure they are accurate and up to date.

Understanding the Key Difference: Per Capita vs. Per Stirpes

When naming individual beneficiaries, two terms that frequently come up in this context are “per stirpes” and “per capita”. While these terms may seem similar, they represent very different ways of dividing an inheritance among your heirs.

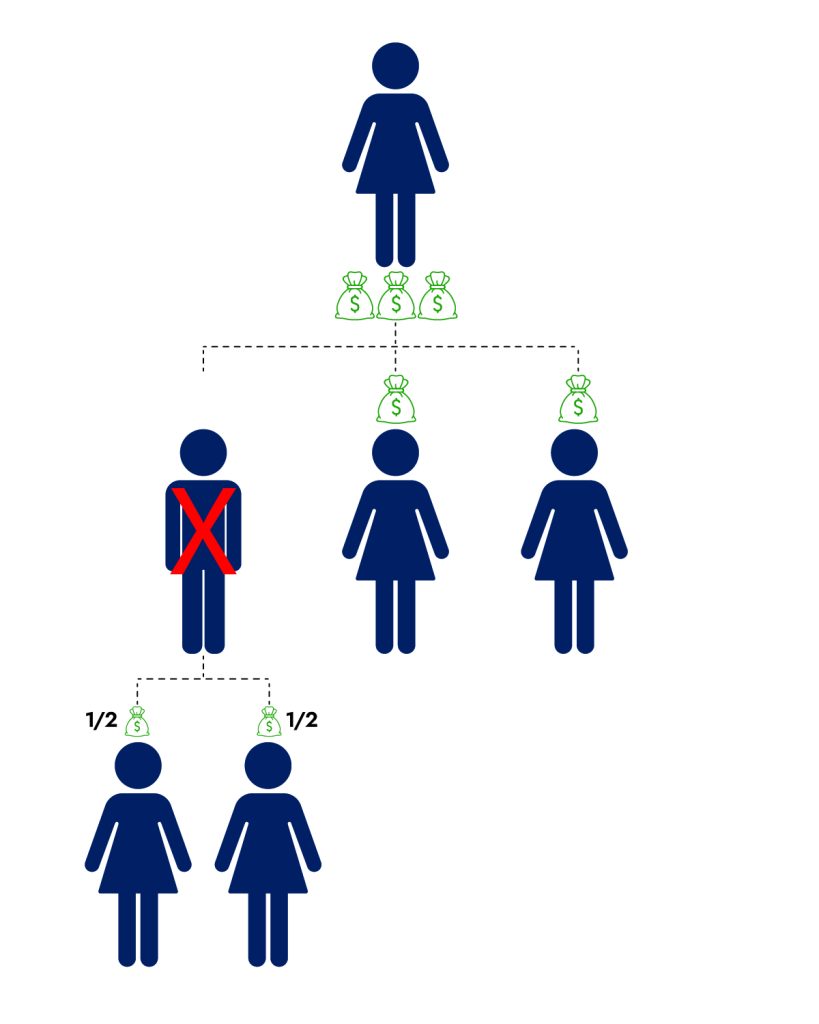

What is “Per Stirpes”?

The term per stirpes translates to “by branch” and refers to dividing an estate among the branches of a family. This method ensures that if an heir predeceases you, their share will be passed on to their descendants. In other words, per stirpes keeps the inheritance within a specific family line.

Example: If you have three children, but one of them passes away before you, the deceased child’s share would be divided equally among their children (your grandchildren). The remaining two children would each receive their full share, and the deceased child’s share would be inherited by their descendants.

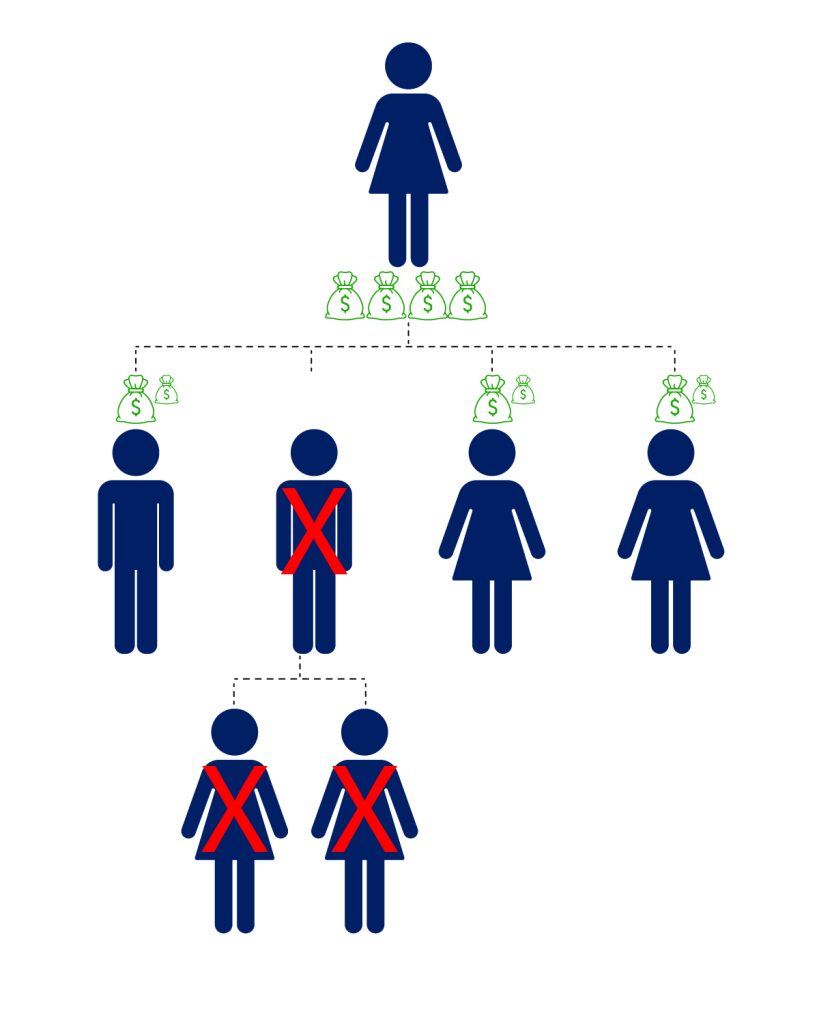

What is “Per Capita”?

Per capita, on the other hand, translates to “by head.” This distribution method divides the estate equally among all living heirs, regardless of their family branch. If one of your heirs passes away before you, their share does not get passed on to their descendants. Instead, the estate is divided equally among the remaining living heirs.

Example: If you have four children, but one predeceases you, the remaining three children would share the full estate equally. The children of the deceased heir would not receive anything, as the division happens equally among the surviving heirs.

While the difference between these two options may seem subtle, the impact on your loved ones can be significant. Choosing the wrong option—or failing to clarify your preference—could lead to unintended consequences, disputes among heirs, or even legal challenges.

Why Review Your Beneficiary Designations Now?

Life rarely stands still. Over time, your family dynamic and financial situation can shift. Perhaps you’ve welcomed new children or grandchildren, experienced a marriage or divorce, or lost a loved one. Each of these changes could alter how you want your assets to be distributed.

Outdated or incorrect beneficiary designations can result in assets being distributed contrary to your intentions. For example:

• A former spouse could unintentionally remain the beneficiary of a retirement account. If there is a per stirpes designation, any new children of the ex-spouse could stand to inherit a portion of the assets, in addition to your own.

• A child or grandchild born after you last updated your beneficiary designations could be left out entirely when using a per capita designation.

Without a clear understanding of per capita versus per stirpes, your heirs may not receive the inheritance you intended for them.

Which Method Should You Choose?

Choosing between per stirpes and per capita depends on your family dynamics and the goals you have for your estate. Here are a few considerations:

Per Stirpes: This method is often ideal for families with multiple generations or if you want to ensure that your descendants (grandchildren, for example) are taken care of. If your family includes children and grandchildren, per stirpes guarantees that each branch of your family is represented.

Per Capita: This method works best for families where you want an equal division of assets among the surviving heirs. It’s particularly useful if you prefer to ensure that all living heirs receive an equal share, regardless of how many generations are involved or descendants of a particular family line there are.

How Confluence Financial Partners Can Help

Your Wealth Manager can help you gather all your account and policy documents, check the names of the beneficiaries listed, the percentages assigned to each, and whether the designation is per capita or per stirpes. Furthermore, we can prepare a report summarizing the disposition of your estate to make sure it aligns with your wishes.

Ready to Make Changes?

Estate planning is complex, and small details can make a big difference. You may need to consult with your existing attorney to update your plan or your wealth manager can make an introduction to a qualified professional to draft a new one. Our team is here to help you navigate these decisions and help ensure your legacy is preserved. Call us today to schedule a personalized beneficiary review. Let’s work together to help ensure your estate plan reflects your current wishes and protects your family’s future. Don’t leave it to chance—act now to avoid unintended surprises tomorrow. Your peace of mind is worth it, and your loved ones will thank you.